north dakota sales tax exemption

No Sales Tax Exemption Available. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950.

U S Bank Business Cash Rewards World Elite Mastercard Review 2022 Fuel Your Business With Rewards Reward Card Cash Rewards Small Business Credit Cards

Carbon dioxide for enhanced recovery of oil and gas or secure geological storage.

. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. North Dakota tax exemption info. No Sales Tax Exemption Available.

As used in this section unless the context otherwise requires. The state enacted a complimentary use tax in 1939. North Dakota has 126 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

South Dakota Form Example. Its important to note that you should only use a North Dakota resale certificate if you truly intend to resell lease or rent the items or use them as parts or ingredients in products for. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the North Dakota sales tax you need the appropriate North Dakota sales tax exemption certificate before you can begin making tax-free purchases.

That state we would require proof of tax paid to exempt you from North Dakota excise tax. It continues that a retailer maintaining a place of business in this state also includes every person who engages in regular or systematic solicitation of sales of tangible personal property in North Dakota by the distribution of catalogs periodicals advertising fliers or other advertising by means of print radio or television media or by mail telegraphy telephone computer database. Step 3 Identify what the purchasers business sells leases or.

The base state sales tax rate in North Dakota is 5. If you hold a North Dakota sales and use tax permit you may file your sales and use tax returns over the. Registered users will be able to file and remit their sales taxes using a web-based PC program.

To obtain the sales tax exemption certificate eligible organizations must contact the Office of State Tax Commissioner. O Preschool organizations religious schools and other educational organizations that do not hold a North Dakota Sales Tax Certificate of Exemption number are not exempt from sales tax. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8.

Taxable sales of 100000 in previous or current calendar year. North Dakota has recent rate changes Thu Jul 01 2021. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

North Dakota Tax Info. 127 Bismarck ND 58505-0599 Phone. Groceries are exempt from the North Dakota sales tax.

North Dakotas current sales and use tax were enacted in 1977. If the owner has not received such an exemption certificate sales tax must be paid at the time of purchase. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

North Dakota has a higher state sales tax than 577 of states. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Therefore you can complete the ND resale certificate form by providing your ND Sales Tax Number.

If you are buying products to resell in the state of North Dakota you can qualify for a sales tax exemption on that purchase by presenting your North Dakota resaleexemption certificate. Select the North Dakota city from the list of popular cities below to see its current sales tax rate. Secondary schools or any other institutions of higher learning must enter their North Dakota Sales Tax Exemption Certificate number E-0000.

In the event that a contractor purchases and installs materials eligible for the exemption and pays the sales tax the owner may apply for a refund of the difference between the amount remitted by the contractor and the exemption. Qualifying organizations include those that provide certain services for senior citizens including health welfare and counseling services. No Sales Tax Exemption Available.

A refund may then be sought. Many states have special lowered sales tax rates for certain. North Dakota has several sales tax exemptions by industry including.

Agricultural commodity processing plant construction materials. L Local Sales Tax Rate. Step 2 Enter the purchasers State of origin and State and Use Tax Permit number.

If the vehicle was purchased outside of the United States there is no tax reciprocity. Additional Remote Seller Information. North Dakota Office of State Tax Commissioner 600 E.

North Dakota has enacted legislation effective June 30 2021 that expands the sales and use tax exemptions for qualifying sales made to senior citizen organizations. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND 58104-7535 7012397165. Effective 712019 the threshold of 200 or more transactions was removed.

Remote Seller requirement is effective 10118 or 60 days after threshold is met whichever is later. 701 328-1246 State Tax Commissioner Website. This page explains how to make tax-free purchases in North Dakota and lists two North Dakota sales tax.

The state sales tax rate in North Dakota is 5000. Obtain a North Dakota Sales Tax Permit. North Dakota became a full member of Streamlined Sales Tax on October 1 2005.

Fill out the North Dakota resale certificate form. With local taxes the total sales tax rate is between 5000 and 8500. North Dakotas original sales tax was enacted in 1935.

To find the total sales tax rate combine the North Dakota state sales. Taxes would be due on the purchase price based on exchange at a rate of 5. Sales tax exemption for power plant construction production environmental upgrade and repowering equipment and oil refinery or gas processing plant environmental upgrade equipment.

Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. Present a copy of this certificate to suppliers when you wish to purchase items for resale. In-State Sales Tax Exemption is NOT Available but items shipped to.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Tax Day 2022 These States Don T Require You To File A Tax Return Cnet

Pay Your Arizona Small Business Taxes Zenbusiness Inc

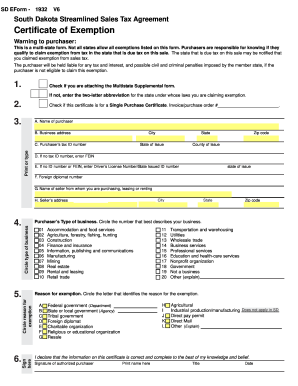

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

State By State Guide To Taxes On Retirees Retirement Tax States

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Sales Tax On Grocery Items Taxjar

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Reg 256 Fillable Forms Facts Form

What Is Sales Tax A Complete Guide Taxjar

Antique Map Of The Dominion Of Canada And British Possessions In North America 1876 Hand Coloured Map Yo Canada

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Inventory Tax To Sales Tax The Complete Guide For Businesses Ware2go